iowa capital gains tax real estate

However the state has an inheritance tax that ranges from 1 to 15. The Iowa capital gain deduction is subject to review by the Iowa Department.

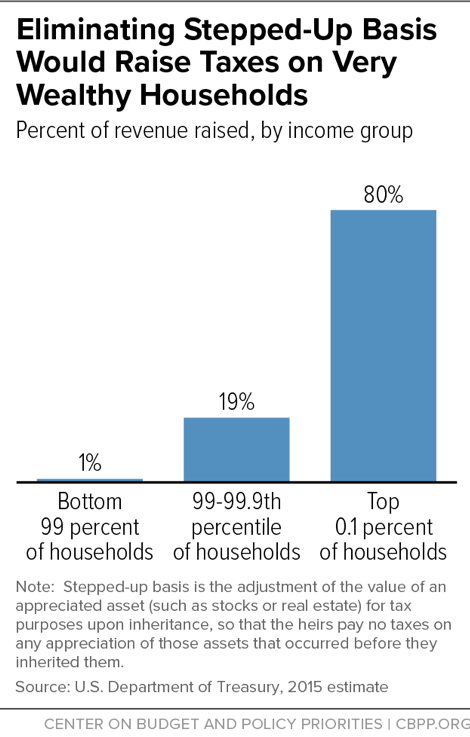

State Taxes On Capital Gains Center On Budget And Policy Priorities

The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

. Contact a Fidelity Advisor. When a landowner dies the basis is automatically reset. Includes short and long-term Federal and State Capital.

The various types of sales resulting in capital gain have specific guidelines which must be met to qualify for the Iowa capital gain deduction. Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet. Capital gains are taxed as ordinary income in Iowa.

Toll Free 8773731031 Fax 8777797427. The 15 rate applies to individual earners between 40401 and. Iowa Capital Gains Deduction.

Real estate property includes residential properties vacant land rental property farm property and commercial land and buildings. Capital Gains Tax on Sale of Property. The rate reaches 715 at maximum.

Taxes capital gains as income. A copy of your federal Schedule D and federal form 8949 if applicable must be included with this return if. Iowa has a unique state tax break for a limited set of capital gains.

When you sell a stock you owe taxes on your gainthe difference between what you paid for the stock and what you sold it for. CPEC1031 of Iowa provides qualified intermediary services throughout the state of Iowa including. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years.

Convert Your Home into a Short-Term Rental. The cutoff for not owing any capital gains tax is now 40400 for individuals and 80800 for married couples filing jointly. The capital gains deduction has a fairly brief history on the Iowa 1040 Individual Income Tax Form.

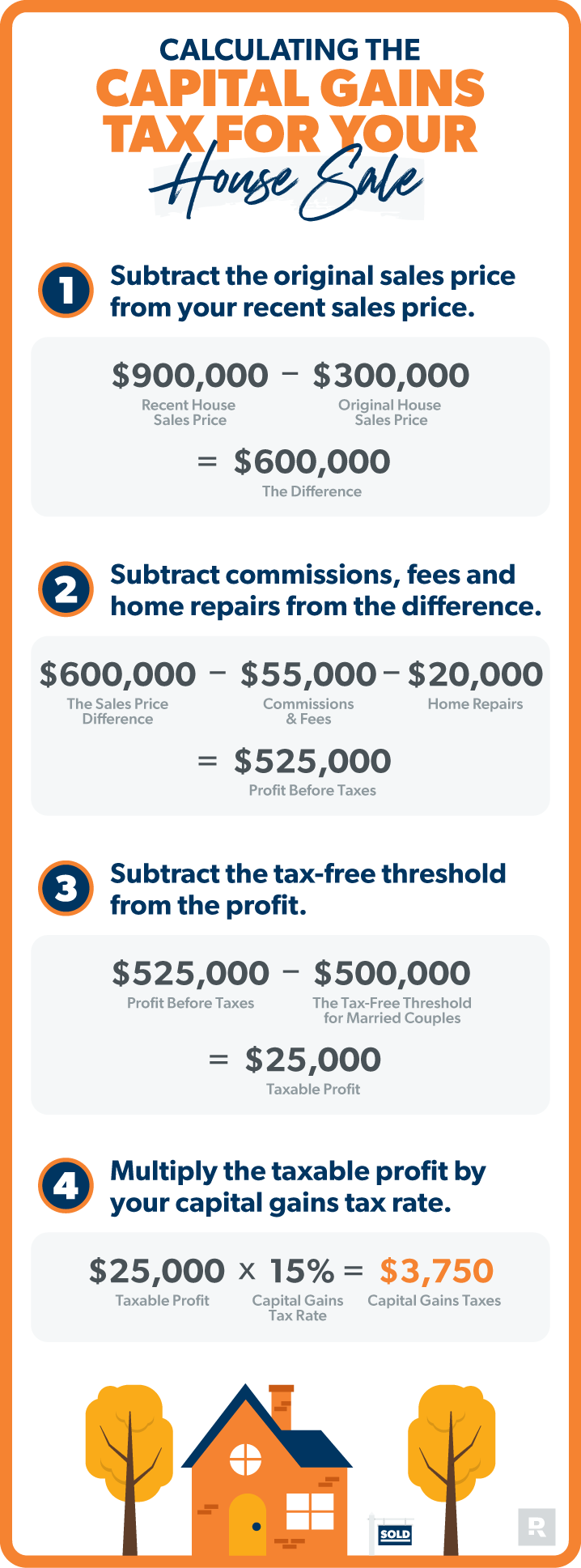

Capital GAINS Tax. That goes doubly when you can avoid capital gains taxes on the first 250000 or 500000 in profits. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or head of.

Capital gains that qualify for the deduction result from the sale. Iowas estate tax was repealed in 2008. The Iowa Learning Technology Commission Iowa LTC creates a 21st century digital learning environment.

See Tax Case Study. Introduction to Capital Gain Flowcharts. Ad Tax-Smart Investing Can Help You Keep More of What You Earn.

Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600. What Is the Capital Gains Tax Rate. Taxes capital gains as income and the rate reaches 853.

No one says you have to. For sales made on or after January 1 1990 Iowa taxpayers could claim a 45. Enter 100 of any capital gain or loss as reported on federal form 1040 line 7.

Iowa tax law provides for a 100 percent deduction for qualifying capital gains. That equals 525000 profit. If line 6 of the IA 1040 includes a capital gain transaction you may have a qualifying Iowa capital gain deduction.

Creates a 21st century digital learning environment. The same is true with selling a home or a second home but. Since the tax-free threshold for married couples is 500000 youll pay capital gains taxes on just 25000.

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

The States With The Highest Capital Gains Tax Rates The Motley Fool

State Taxes On Capital Gains Center On Budget And Policy Priorities

Capital Gains Yield Cgy Formula Calculation Example And Guide

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Can Capital Gains Push Me Into A Higher Tax Bracket

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Property

How High Are Capital Gains Taxes In Your State Tax Foundation

State Taxes On Capital Gains Center On Budget And Policy Priorities

If I Sell My House Do I Pay Capital Gains Taxes Edina Realty

2022 Capital Gains Tax Rates By State Smartasset

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

How To Calculate Capital Gains Tax H R Block

Capital Gains Tax Iowa Landowner Options

How Much Is The Capital Gains Tax On Real Estate Ramseysolutions Com